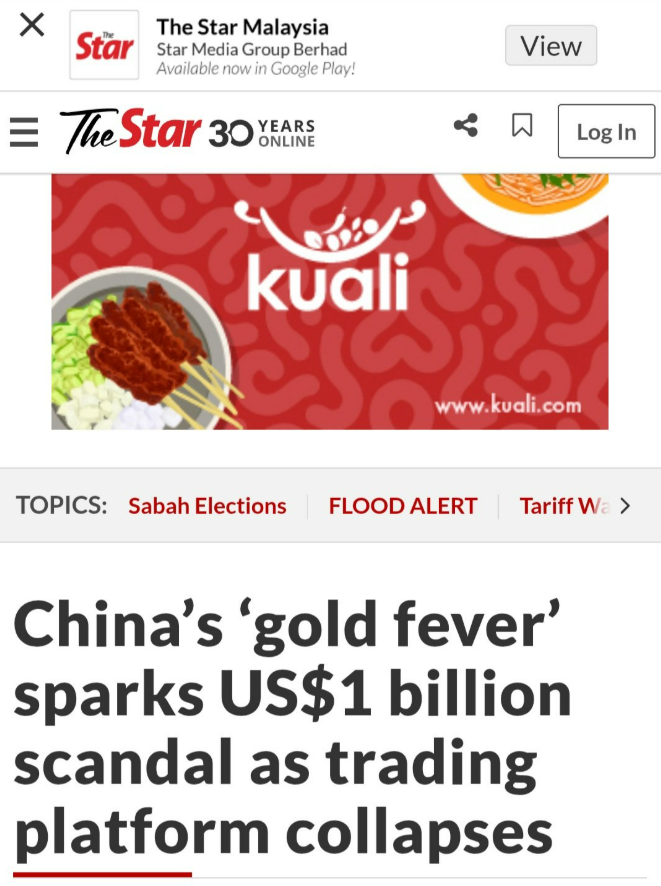

JieWoRui, China’s “trust us with your gold” investment platform, just froze a staggering $19 billion in customer assets, locking users out of both withdrawals and physical delivery. Their solution? A weak offer to pay 20% back, maybe, someday. Investors are furious.

🇨🇳 $19B GONE: CHINA’S GOLD TRADING SCHEME BLOWS UP

JieWoRui, China’s “trust us with your gold” investment platform, just froze a staggering $19 billion in customer assets, locking users out of both withdrawals and physical delivery.

Their solution? A weak offer to pay 20% back,… pic.twitter.com/8EGM18P7e9

— Mario Nawfal (@MarioNawfal) February 1, 2026

- $19 Billion is chump change to China. I think you are talking about shit you don’t understand. You really think the CCP would allow some investment manager to steel 19B in the most surveilled state in the world. They track every call, every transaction, every text message yet somehow this dude was able to take $19B. That doesnt pass the smell test. – Ryan Matta

- It’s basically a gambling platform, and the $19 billion is likely a x10 exaggeration. Yeah, they aren’t collecting on their bets, but they also aren’t losing massive amounts of money either. When you make a bet, make sure your bookie is able to pay when you win. – Leroy

- Imagine that the CCP stole $19Billion from its own people ($15Billion if they pay back the 20% … if). They call that a Saturday in Beijing. – KON

- $19 billion vanished isn’t just a number; it’s a terrifying seismic shock to global trust. This isn’t merely a platform collapse; it’s a stark warning for *everyone* holding paper gold derivatives. Wake up! The pathetic 20% “solution” isn’t an insult; it screams systemic failure. This is a game-changing moment proving promised physical delivery remains a ledger entry. The true fear is how deep this rabbit hole extends globally. Here’s what nobody’s talking about: the terrifying global disparity between paper and physical gold. Estimates suggest only 10% of “investment gold” exists. This $19B vanishes, yet 80% of investors still trust fractional reserve systems. So, with $19B gone, are you *still* confident your digital gold promises will materialize? Or is this the ultimate proof that physical ownership is the *only* safe haven when the system breaks? – Golden Paul