In this video, we’re taking an honest look at what’s really happening with car prices in the United States right now. New car prices have crossed the $50,000 average. Monthly payments are pushing $700, $800, even over $1,000 a month. And it’s not just luxury vehicles — we’re talking about base model sedans and SUVs that used to be considered affordable. A Honda Civic now costs over $30,000. A Toyota RAV4 can run you over $40,000. These aren’t premium trims. These are everyday cars for everyday people. And the problems don’t stop at the sticker price. Interest rates are hitting double digits for a lot of buyers. Loan terms are stretching out to six and seven years. People are financing $30,000 cars and ending up paying $45,000 or more by the time it’s all said and done. One in five financed vehicles now carries a monthly payment over $1,000. That’s not a car payment, that’s a second rent check.

We’re also looking at what’s happening to young Americans who are trying to do the right thing, get reliable transportation so they can work, go to school, and build a life. Many of them are getting locked into loans they can barely afford, only to realize a few months in that they’re stuck. The car has already lost value, the payments keep coming, and there’s no easy way out. Used cars aren’t much better either. A decade-old Honda can still cost $13,000 to $15,000, and many lenders won’t even finance anything older than ten years. Then there’s the quality issue. American car brands are charging more than ever, but the build quality hasn’t kept up. Brand-new trucks and cars are rolling off the lot with misaligned panels, mechanical problems, and issues that shouldn’t exist on a vehicle you just spent tens of thousands of dollars on. When you’re already stretched thin financially, an unexpected repair bill on a car that’s supposed to be new is the last thing you need.

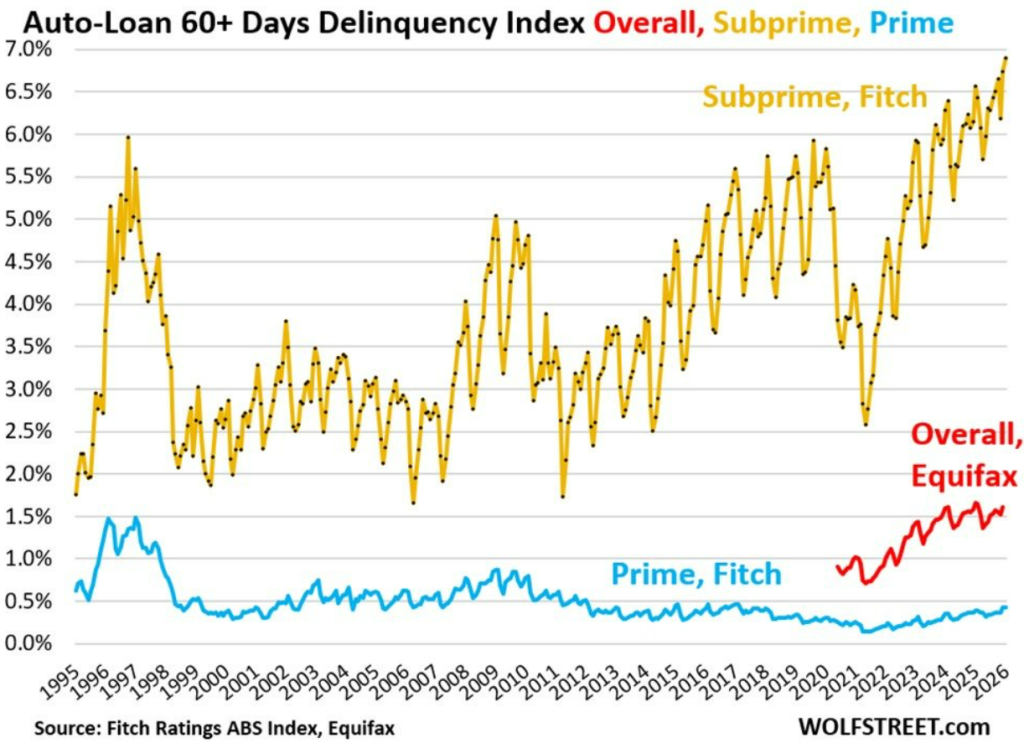

And for a growing number of people, this is all leading to one place, being upside down on their auto loans. Owing more than the car is worth. Falling behind on payments. Facing repossession. Auto loan delinquencies are climbing, and more and more Americans are finding themselves trapped in debt with no clear path forward. This isn’t about people making bad decisions. This is about a system that has made it nearly impossible to own a vehicle without taking on serious financial risk. Cars are a necessity for most Americans, not a luxury, and the market has turned that necessity into a trap. If you’ve been feeling the pressure of car prices, you’re not alone. Drop a comment below and share your experience. What are you driving? What are you paying? And what do you think needs to change? #carmarket #carpayments #autoloans #financialliteracy #debtfree #usedcars #newcars #carprices #personalfinance #economy #costoflivingcrisis #carbuyingtips #automarket #financialtrap #americaneconomy

BREAKING: The 60+ day delinquency rate on US subprime auto loans is up to a record 6.9%. Serious delinquency rates have more than DOUBLED since 2021. This exceeds the 1996 peak by 0.9 percentage points. For context, the 2008 Financial Crisis high was 5.0%. Meanwhile, total auto debt is up +$312 billion over the last 5 years, to a record $1.67 trillion, driven by surging vehicle prices. Subprime financing makes up ~14%, or $234 billion, of all auto loans. Americans are falling behind on their car debt at a record pace.

The subprime auto breakdown • 2008 crisis peak: 5.0% delinquency • Today: 6.9% ALL-TIME record • Total auto debt: $1.67T (+$312B in 5 years) • $234B in subprime loans currently at risk

- And with total auto debt at a record $1.67T and vehicle prices still elevated, there’s no relief in sight for borrowers. When delinquency rates surpass 2008 levels, that’s not a blip — that’s a trend worth watching closely. The cracks are showing. DS

- Right now this reads as: Lower-income strain inside an otherwise resilient aggregate economy. The bigger risk isn’t auto loans alone — it’s what the Fed minutes already flagged: private credit + leveraged funds + concentration risk. If consumer stress rises while financial leverage is high, that’s when things compound. subprime auto is about 14% of the $1.67T market (~$234B). That’s meaningful, but it’s not system-dominant like subprime mortgages were in 2007–08. Housing was a multi-trillion-dollar asset class embedded throughout bank balance sheets and structured products globally. Auto loans are smaller, shorter-duration, and more quickly liquidated. auto loans don’t have the same systemic multiplier. If someone defaults on a car: •The lender repossesses it. •Loss severity is contained. •There’s no cascading home equity wipeout effect. •It doesn’t freeze global funding markets. This is a credit stress signal, not a systemic collapse signal. Thoughts, guys? – LRH

- 6.9% on subprime auto delinquencies is not a small number. That’s stress building in the weakest part of the credit market. When lower-income borrowers start missing car payments, it usually means cash flow is tight everywhere else too. It’s not 2008 housing scale, but it’s a signal. Credit cracks always start at the edge before moving inward. Question is whether this stays contained… or spreads into broader consumer credit. – Lynx